Molybdenum market update on May 14, 2025

The overall domestic molybdenum market in China is currently moderate, primarily characterized by difficulties in updating product prices and a stable order growth rate. Industry attention is focused on the shipment dynamics of molybdenum mining companies, the volume and pricing of steel tenders, and the impact of tariff policy adjustments on the molybdenum industry's development.

In the molybdenum concentrate market, with steady downstream demand and tightening spot supply, transaction prices have seen a slight increase to around 3,530 yuan/ton-degree. In the ferromolybdenum market, a dilemma persists due to rising raw material costs conflicting with lower steel company bids, leading to intense price negotiations between buyers and sellers. In the molybdenum chemical products and derivatives market, a strong wait-and-see atmosphere prevails, with firm raw material pricing sentiment and terminal customers primarily purchasing based on need, resulting in no significant price changes.

According to the China Iron and Steel Association, in early May 2025, the social inventory of five major steel varieties across 21 cities totaled 8.5 million tons, down 4.0% month-on-month, up 29.0% from the beginning of the year, and down 26.4% compared to the same period last year. By region, social steel inventories in all seven major areas showed declines month-on-month except for South China, which saw an increase. East China recorded the largest inventory reduction, while Northwest China had the largest percentage drop. Among the five major steel varieties, cold-rolled coil inventories saw a slight rise, while medium-thick plate inventories remained stable, with other varieties showing varying degrees of decline, notably rebar, which had the largest reduction and drop in percentage terms. Year-on-year, social inventories of all five varieties declined to different extents.

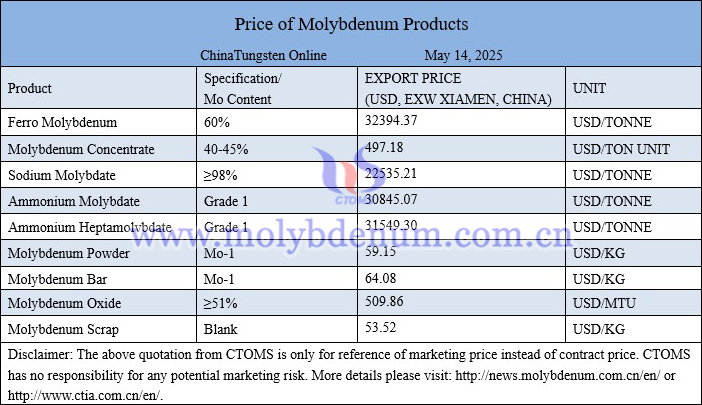

Price of molybdenum products on May 14, 2025

Molybdenum crucible picture

![[Know Tungsten] Packaging, Storage and Transportation of Tungsten Flux Packaging, Storage and Transportation of Tungsten Flux](http://0535idc.cn/en/wp-content/uploads/2025/05/tungsten-flux-packaging-en-20250513-214x140.jpg)