Analysis of latest tungsten market from Chinatungsten Online

On Monday, tungsten prices remained generally stable, with weak market trading sentiment persisting due to relatively slow demand recovery.

At the macroeconomic level, the effectiveness of domestic economic and consumption-related stimulus policies remains to be observed, while the challenging trade environment under major power competition continues to negatively impact exports, consequently dampening market sentiment in the tungsten sector. The atmosphere of insufficient confidence is unlikely to reverse in the short term.

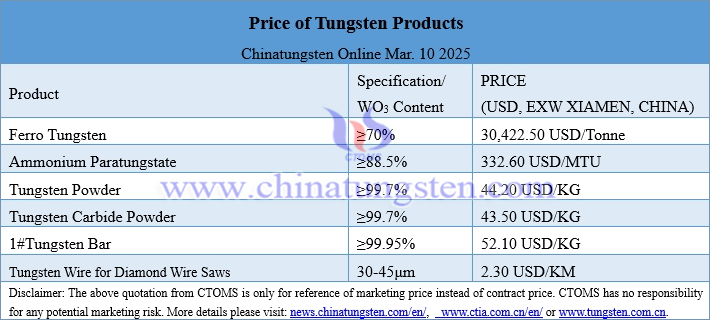

The price of 65% black tungsten concentrate stands at $19,859.2/ton. The tight supply situation shows no significant improvement, leaving limited room for price concessions from holders. However, persistently weak demand continues to suppress purchasing willingness among market participants, with market transactions remaining in a stalemate driven by necessity.

Ammonium paratungstate (APT) prices are quoted at $334.2/mtu. Multiple bearish factors including sluggish downstream demand, challenging foreign trade conditions, and downward adjustments in long-term contract prices have collectively contributed to negative market sentiment and confidence erosion in recent periods.

Tungsten powder prices hold at $44.2/kg while tungsten carbide powder maintains at $43.5/kg. Affected by insufficient orders in downstream cemented carbide and tool manufacturing industries, procurement activities remain strictly need-based. Slow inventory digestion and limited market momentum characterize current market conditions.

Ferro tungsten (70% W) prices are reported at $30,422.5/ton. Recent weakness in both raw material supply and demand sides has constrained trading enthusiasm, with overall market operations maintaining price-following patterns under pressure.

The scrap tungsten market continues to face downward pressure, influenced by both the bearish sentiment from primary material markets and stagnant demand in recycled tungsten applications. Weak terminal consumption continues to suppress market vitality.

Cobalt powder prices stabilize at $27.5/kg. The market remains caught between supply chain shortage concerns and weak consumption pressures, with cautious sentiment dominating transactions. Both buyers and sellers maintain a wait-and-see approach, resulting in price stagnation and temporary suspension of upward momentum.

Prices of tungsten products on March 10, 2025

Picture of tungsten aloy rods